Contents:

Conversely, a value of 30 indicates the security is oversold. The larger the difference between today and yesterday – the stronger the momentum. However, identifying the trend and trading with its direction makes sense in probability outcomes. Investments involve risks and are not suitable for all investors. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider.

Basically, these https://g-markets.net/ indicators are used to support your price chart analysis. Most Forex trading platforms should come with a default set of the most popular technical indicators. To find an fx platform, we recommend the forex trading platform section of Compare Forex Brokers visit https://www.mobile-home-buyers.com/montana/.

As such, you will need to be well versed in technical analysis to succeed in this segment of the forex trading scene. Traders can use EMA to find signals of trades in terms of crossovers or divergences. You can mainly find trends in oversold and overbought market conditions. This indicator is also famous for finding resistance levels, support, reversals, and many more. Sentiment indicators focus on the number of trades and traders to show the position of trades and traders in a particular currency pair. Forex indicators can be extremely useful if you keep it simple, but it can get problematic if it gets too complicated.

Low Barrier to Entry

It is rarely applied to Forex trading, as there are no data on real volumes on the OTC market. The VROC is suitable for professional traders who prefer stock assets. The Chaikin Oscillator will be of interest to a professional stock trader. The tool is rarely applied in Forex trading, as there are difficulties with the consolidation of real trade volumes.

The two exponential moving averages used are the 12-period and 26-period. The histogram is a 9-period exponential moving average of the MACD line. The Relative Strength Index, otherwise known as the RSI, is a momentum oscillator developed by J.

Best way of using Forex pivot point indicator in trading

At point 1, the uptrend continues after the local correction, and the signal needs confirmation. At points 2,3, and 6, the signals are clear, and the trend reverses in all three cases. At point 5, we do not consider the signal, as the market is trading flat. Coppock Curve is a trend indicator, based on the moving average, fast and slow oscillator lines of the ROC indicator. It is one of the best indicators for forex if you are a professional trader and can spot reversal patterns and understand mathematical formulas of complex indicators.

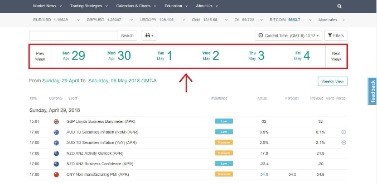

First up, use theon-balance volume indicator to measure the positive and negative flow ofvolumein a security over time. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. This is why the indicator chooses not to show the details of every release, instead, it focuses on the release time and market impact at a glance.

If you decide to get in as quickly as possible, you can consider entering a trade as soon as an uptrend or downtrend is confirmed. On the other hand, you could wait for a pullback within the larger overall primary trend in the hope that this offers a lower risk opportunity. For this, a trader will rely on an overbought/oversold indicator. Euro/yen cross with 50-day and 200-day moving averages and MACD indicator.

When the lines start meeting together, it is the exit signal. Some of them are the versions of basic tools, upgraded and modified basic tools. Other custom indicators are original tools based on standard algorithms or unique developments. You can get acquainted with original indicators on the TradingView website or on the MQL5 website, the MT4/MT5 developer. Also, in MQL5, in the freelance section, you can order programmers to write an indicator code based on the original trading algorithm and an input data set.

OBV uses price volumes to indicate the changes and trends. Traders can use OBV to predict the market price of an asset. You can determine the buying and selling pressure of security by using the flow of volume. Day trading depends on the time of trading assets held in the hand of the traders. A day trader may hold assets for a few seconds to less than a day.

Want to sell your home without listing it? Explore https://www.cash-buyers.net/new-york/cash-buyers-for-houses-smithtown-ny/ for cash buying opportunities.

Non-Repainting Indicators in Forex Trading

The important thing about debest indicators for day trading forexining trade exits is to make a method which ensures you participate well in the big winners. It is worth remembering that you cannot realistically hope to get exits exactly right all or even most of the time. The best you can achieve is to reach a balance between sticking with winners and not staying too long with losers. You will never get even close to exiting in all the optimal places in all your trade, so it is best not to try too hard at that.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

Test the indicator on a demo account in all kinds of market situations, determine the moments when the signals are the most accurate. For example, there are indicators that do not work in trading flat or in minute timeframes. Combination with technical indicators, when smoothing by the moving average method is required, for example, with the VWAP indicator. One can well apply basic technical indicators, but the signals should be confirmed with fundamental and chart analysis. They show the market saturation with buy or sell volumes .

Squeeze pro indicator

If properly used, technical indicators can add a new dimension to understanding how the price moves. The best trading strategies will often rely on multiple technical indicators. It’s well known that many traders, especially novice traders use technical indicators as their primary tool in analyzing the price movement. Forex indicators are simply tools used in the technical analysis process to forecast future price movement. Instead, we are looking to see if the trend-following tool and the trend-confirmation tool agree. I also use MA to determine short to long term trends and for Stop Losses too.

One thing to note is that although these large numbers of indicators are free, Basic plan users can only add up to a maximum of 3 indicators at one time. TradingView offers a comprehensive library of FREE indicators regardless of a user’s account subscription. TradingView indicators can be found with one click of a button on the chart.

When we talk about round numbers, we’re alluding to prices at “00 levels” and “50 levels”. There’s no denying that these levels are significant when you watch price action. They play an important role in drawing support/resistance levels that are being watched by the most number of eyes.

Moreover, the volume indicator is so versatile that it can also be used to confirm a Forex breakout. Identifying breakouts will allow you to trade ahead of the market. The best trading indicator for you will depend on your trading goals. A confirming technical indicator can be extremely useful to validate your price analysis. As its name suggests, confirming indicators are only used to confirm that the reading of price action is correct.

In section 3, the MACD lines converge, and the bars are small, the market is balanced. SP – calculation period of the slow ЕМА, FP – period of the fast ЕМА. Any types of trend following and counter-trend trading strategies. This is one of the best forex indicator combinations, drawing a price range, based on the MAs. Ichimoku is most often applied to trading currency pairs.

Dow Jones Technical Analysis: The Indicator is Colored Red – DailyForex.com

Dow Jones Technical Analysis: The Indicator is Colored Red.

Posted: Thu, 23 Mar 2023 12:56:04 GMT [source]

The break of an RSI trendline might indicate a potential price continuation or a reversal. Which settings to choose when using the RSI indicator for day trading depends on your strategy. Total daily volume is assigned a positive number if it increases, in comparison to the previous day.

The difference between EMA other MA’s, Is EMA’s assign exponentially greater weight to more recent price performance. This makes them EMA more sensitive to recent price movements. There are thousands of indicators traders can use when trading.